Happy New Year, time for visas and Insurance!

|

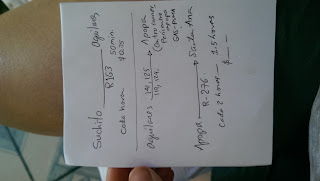

| Greg looking awesome |

Although Bryony and I are going for an all round minimalist approach (not booking in advance ) there are still lots of important things to sort before getting on the plane. Firstly, we sorted our visas/waivers, this is easy to do but could scupper your plans if not thoroughly researched. We are transiting through Canada and the USA. To do this we need Electronic Travel Authorizations for both countries. Both systems are pretty cheap (£14 each) and take around 10 minutes to complete. The US ESTA gives you 29 days to transit through the country, allowing us to leave the airport and check into a hotel during our 13 hour layover. If ETAs are not approved before travel, you will be stopped at the border and although it can usually be sorted there, a considerable amount of stress will be created and you may miss conecting flights. For Central America most Visas for travelers can be bought at the border, last for 90 days and are easily renewed by going through another border.

The next thing that Bryony and I sorted was our insurance, which turned out to be a real pain. This section is a little bit of advice for those planning on a similar type of travelling experience as us.

The next thing that Bryony and I sorted was our insurance, which turned out to be a real pain. This section is a little bit of advice for those planning on a similar type of travelling experience as us.

First word of advice: read the small print. I know, it's a bit of a cliche but that is how insurers get out of paying for your stuff.

Secondly, check their 'proof of return policy', many insurers require you to have return flights booked OR some sort of proof of return; these can be quite specific and are detailed in the Ts&Cs of the company. In the case of one company, our insurance would have become null and void within 48 hours without the purchase of a return ticket. So far, we have only found two insurers that do not require proof of return to the UK type of policy, these are: World Nomads and Globelink international. There is not much between these two and they both have good reputations. World Nomads is recommended by many travel bloggers and provides good all round cover including for gadgets, however Globelink is substancially cheaper, even with added gadget cover. The next thing that may bite an unwary traveler is baggage cover. Mostly, it is advised that you bring as few expensive items as possible. However for those into photography or wishing to use their laptops most standard cover will not be adequate as many will only pay out up to £200 for an individual item. For us this meant adding more than £60 to our policy to cover some specific items. This leads me on to my next point, proof of ownership. Insurers require you to prove that you own an item that you are claiming for (even if specifically named on the policy) this almost exclusively means being able to produce an original receipt. This almost got me when trying to insure my camera as the box was in another house and I had to get my Mum to go and have a look for it. Luckily, it was there which made life much easier. Note to self, always keep important receipts safe. Last but not least, Medical insurance. This aspect seems to be pretty good with most travel insurers with £5 million being one of the lowest max pay outs and will cover most eventualities. However, be warned that some may require you to pay for your own flights home if they are not already booked or will not pay out under circumstances deemed to be self inflicted e.g. bungee jumping. I would recommend having a quick read of the policy wording if you are aiming to be particularly adventurous and, as with gadget cover, adding extra if necessary.

All in, insurance can end up being one of your biggest one off expenditures and if all goes well you won't need it. However, things rarely go to plan and it is worth doing a bit of extra reading to make sure that when everything goes tits up, you can try to piece things back together again.

I hope that this is a useful breakdown of a few things that are easily missed when getting ready to travel, the list below gives a few brief points of what has been covered. Next time, I think Bryony will be writing a blog covering our choice of bags and maybe foot wear. I will also be working on a synopsis of a few choices of how to carry around your money.

Till next time,

Greg

EDIT: Information on visas/esta waivers in this blog is only relevant to eligible nations and citizens so read the T&Cs to check what is applicable to you.

TL;DR Check list

All in, insurance can end up being one of your biggest one off expenditures and if all goes well you won't need it. However, things rarely go to plan and it is worth doing a bit of extra reading to make sure that when everything goes tits up, you can try to piece things back together again.

I hope that this is a useful breakdown of a few things that are easily missed when getting ready to travel, the list below gives a few brief points of what has been covered. Next time, I think Bryony will be writing a blog covering our choice of bags and maybe foot wear. I will also be working on a synopsis of a few choices of how to carry around your money.

Till next time,

Greg

EDIT: Information on visas/esta waivers in this blog is only relevant to eligible nations and citizens so read the T&Cs to check what is applicable to you.

TL;DR Check list

- Make sure you have the appropriate Visas and travel documents

- Get insurance

- Check the policy wording

- Is there a 'proof of return' policy (do you need return flights etc.)

- What do you need to prove ownership when claiming for baggage or expensive items

- What is the max pay out for an individual item.

- Are there types of items (i.e. phones) that are not covered

|

| Devon traffic jam |

Comments

Post a Comment